Bajaj Finance, one of India’s leading non-banking financial companies (NBFCs), has seen impressive growth in its stock price over the years. Known for its robust business model, customer-focused approach, and strong market presence, Bajaj Finance continues to be a favorite among investors. This blog delves into the latest Bajaj Finance share price, its performance, and the future outlook of the stock.

1. Understanding Bajaj Finance: A Market Leader

Bajaj Finance Ltd. is part of the Bajaj Finserv Group, which was established in 2007. Over the years, Bajaj Finance has become a dominant player in India’s financial services sector, offering a wide range of products, including:

- Personal Loans

- Business Loans

- Fixed Deposits

- Consumer Durable Loans

- Insurance and Investment Products

Bajaj Finance has consistently maintained strong growth, driven by its ability to adapt to changing market conditions and focus on digitization. As of 2025, the company remains one of the most valuable NBFCs in India.

2. Current Bajaj Finance Share Price Trends

As of June 2025, Bajaj Finance’s share price has been performing admirably. The stock has shown significant resilience and growth over the past year, reflecting the company’s strong fundamentals.

| Date | Bajaj Finance Share Price (₹) |

|---|---|

| June 2025 | ₹8,050 |

| May 2025 | ₹7,950 |

| April 2025 | ₹7,300 |

| March 2025 | ₹7,100 |

The share price reached a 52-week high of ₹8,200 and has recently shown healthy correction after the peak. Investors are closely watching the stock for its mid-term performance, especially with the upcoming quarterly results. (MoneyControl)

3. Key Factors Driving Bajaj Finance’s Stock Performance

Several factors contribute to the strong performance of Bajaj Finance’s share price:

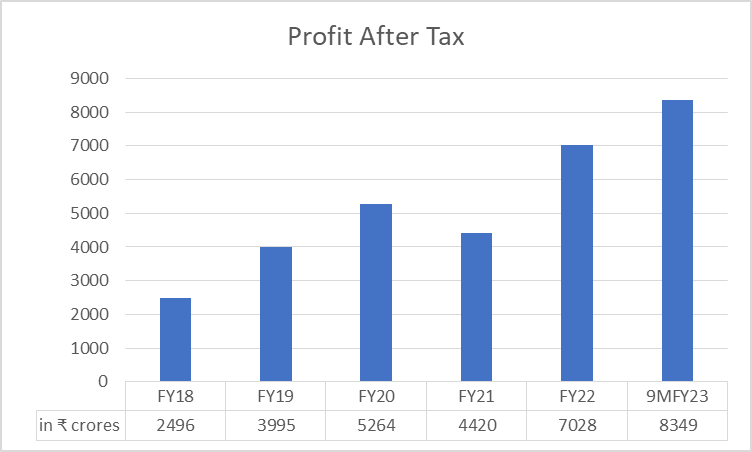

- Strong Financial Performance: The company has consistently posted strong earnings with robust growth in its loan book. For FY2024, Bajaj Finance reported a 22% YoY growth in net profit.

- Market Leadership: With a dominant market share in retail loans, Bajaj Finance continues to capitalize on its wide product portfolio. It has revolutionized the way retail finance is approached in India by introducing innovative consumer financing models.

- Diversified Business Model: Bajaj Finance’s diversified revenue streams, including loans, insurance, and mutual funds, have allowed it to hedge against market volatility.

- Strong Digital Adoption: The company’s heavy investment in technology and digital transformation has improved its customer reach and operational efficiency.

- Partnerships and Acquisitions: Strategic partnerships, including those in the healthcare, e-commerce, and digital lending space, have further bolstered Bajaj Finance’s growth.

4. Investment Insights: Should You Invest in Bajaj Finance?

Growth Prospects

Bajaj Finance has maintained a strong growth trajectory over the years, and the long-term outlook remains positive. The company is well-positioned to benefit from:

- Increasing penetration of retail loans in India.

- Rising disposable income and consumption growth.

- Digitization of the financial services sector.

- Government policies supporting the NBFC sector.

Valuation

As of June 2025, Bajaj Finance’s Price-to-Earnings (P/E) ratio stands at 36, indicating that the stock is priced at a premium. While this may seem high, the stock’s consistent growth justifies the valuation. Investors are willing to pay a premium for Bajaj Finance’s market leadership and high-growth potential.

Risks and Challenges

While the growth outlook for Bajaj Finance is strong, there are certain risks that investors must keep in mind:

Market Volatility: As with any stock, Bajaj Finance’s price can be impacted by market conditions, global economic factors, or a downturn in the financial services sector.

Regulatory Changes: As a non-banking financial company, Bajaj Finance’s business is subject to changes in regulations, especially concerning interest rates and capital requirements.

Credit Risk: With an increasing loan book, the company is exposed to higher credit risk, especially in the consumer finance sector.

5. Bajaj Finance Share Price: Performance vs. Competitors

In comparison to its peers, Bajaj Finance has outperformed many of the top NBFCs and financial institutions in the Indian market. Let’s take a look at its performance relative to its competitors:

| Company | 1-Year Price Change | PE Ratio | Market Cap (₹ Cr) |

|---|---|---|---|

| Bajaj Finance | +14% | 36 | ₹4,20,000 |

| HDFC Ltd. | +9% | 23 | ₹5,50,000 |

| ICICI Lombard | +8% | 28 | ₹1,80,000 |

| Muthoot Finance | +6% | 18 | ₹1,50,000 |

As shown, Bajaj Finance has outpaced HDFC Ltd. and ICICI Lombard, despite being priced at a premium, thanks to its solid growth and leadership in retail lending.

6. Bajaj Finance: Future Outlook and Stock Prediction

Looking ahead, analysts predict that Bajaj Finance’s share price will continue its upward trajectory, driven by:

- Increased demand for retail credit, particularly in consumer durable loans.

- Expansion into new verticals like mutual funds, insurance, and asset management.

- Resilience in challenging times, with Bajaj Finance’s strong balance sheet and capital management practices.

While the stock may face some short-term volatility due to market conditions, the long-term outlook remains bullish. Some analysts are forecasting Bajaj Finance’s share price to reach ₹9,000–₹10,000 in the next 12–18 months, depending on market and economic factors.

7. Where to Buy Bajaj Finance Shares

You can purchase Bajaj Finance shares through major stock exchanges in India such as the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). Alternatively, online brokerage platforms like Groww and Zerodha allow easy access to Bajaj Finance shares.

- Groww: Offers seamless access to Bajaj Finance shares with a user-friendly interface.

- Moneycontrol: Provides live data, charts, and expert insights.

- Screener: A great tool for fundamental analysis.

8. Conclusion

Bajaj Finance has proven itself as one of India’s most reliable financial stocks, consistently delivering robust performance. While the stock might seem priced high, its solid growth prospects and market leadership make it a worthy investment for long-term investors. With increasing demand for retail credit, digital transformation, and regulatory support, Bajaj Finance is likely to remain a dominant player in the NBFC space.

📌 External Links for Further Research

💔 Meghalaya Couple Tragedy: Full Story, Timeline & Investigation