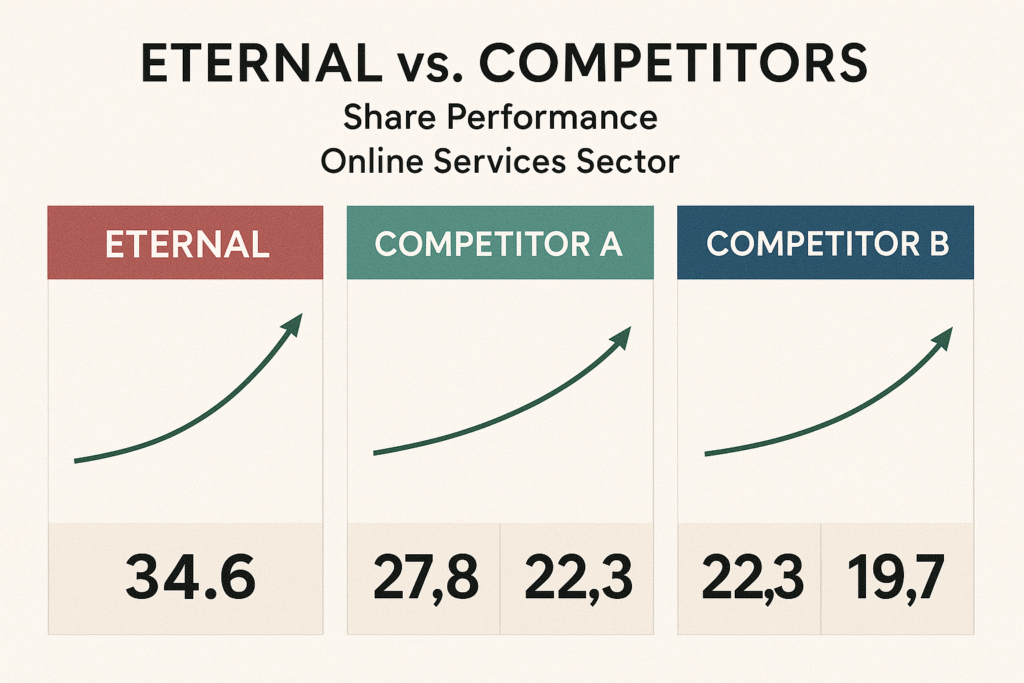

Eternal Online Services Ltd. has emerged as a trending stock on Dalal Street, drawing attention from retail investors and institutional players alike. With a growing digital footprint and a bullish outlook, the Eternal share price has become a hot topic in the Indian stock market.

In this blog, we’ll explore Eternal’s stock performance, recent trends, technical indicators, and investment outlook, backed by insights from top sources like Moneycontrol, Screener, and India Today Business.

💸 Eternal Share Price: Current Status

As of June 5, 2025, Eternal’s share price is trading around ₹293.50, reflecting a 4% intraday gain. This upward move follows positive sentiment around its recent quarterly results and fresh coverage from Morgan Stanley.

📌 India Today Business reports that Morgan Stanley has reiterated a buy rating with a target price of ₹320, citing robust digital demand and operating efficiency.

📊 Share Price Performance – Last 6 Months

| Period | Price Change | % Growth |

|---|---|---|

| 1 Month | ₹268 → ₹293 | +9.3% |

| 3 Months | ₹244 → ₹293 | +20.1% |

| 6 Months | ₹202 → ₹293 | +45.0% |

These figures reflect strong momentum and indicate growing investor confidence.

For live market charts and history, visit Moneycontrol’s Eternal page

🔍 Company Overview: Eternal Online Services Ltd.

Eternal operates in the online services and digital IT sector, offering scalable solutions in cloud storage, digital infrastructure, and B2B SaaS. The company has been rapidly expanding its international footprint, contributing to improved revenue margins.

Key Metrics (as per Screener):

- Market Cap: ₹1,200 Cr+

- ROCE: 14.8%

- Debt-Free: Yes

- Promoter Holding: 52.3%

See full financials at Screener.in

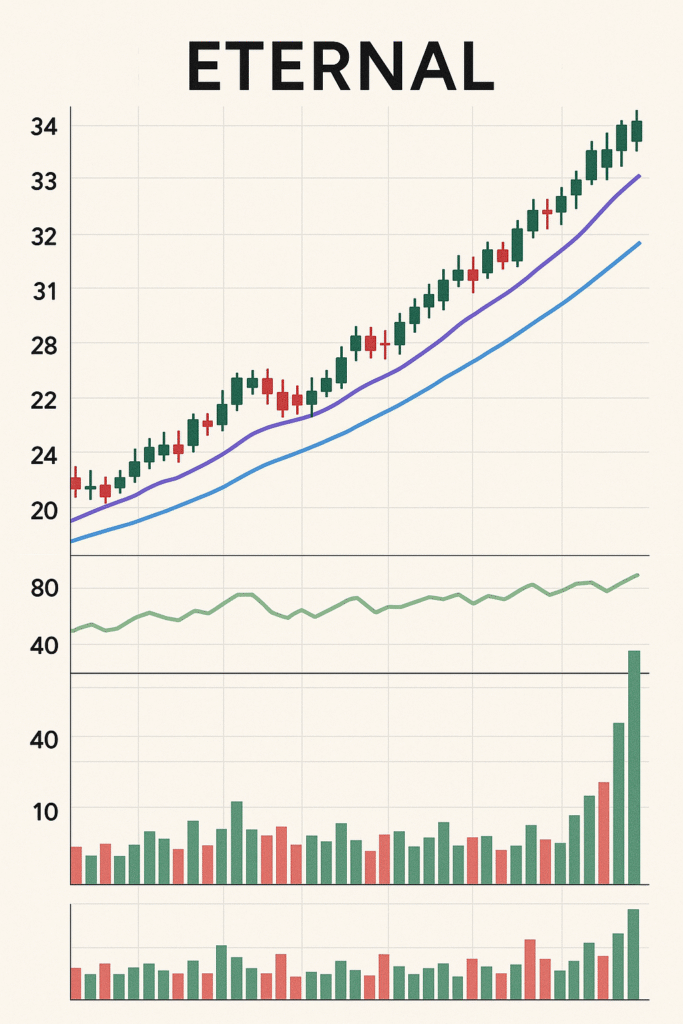

📈 Technical Analysis & Target Price

Technical analysts have pointed out that Eternal’s stock has recently broken a key resistance at ₹280 and may target ₹310–₹325 in the short term.

RSI & MACD Indicators:

- RSI: 61 (bullish)

- MACD: Positive crossover

- 50-DMA: ₹271

- 200-DMA: ₹233

A positive breakout above ₹295 with strong volume could push the stock higher toward its 52-week high.

🛠️ Should You Invest in Eternal?

Pros:

- Strong sector (Digital Transformation)

- Debt-free balance sheet

- Increasing institutional coverage

- Strong YoY revenue growth

Risks:

- Market volatility

- High valuations vs. earnings

Analysts recommend cautious entry with a stop loss at ₹270 and a target of ₹320–₹340 in the medium term.

💹 Eternal Share Price Today

As per Moneycontrol, the share price of Eternal Ltd on June 5, 2025 stands at around ₹298, showing a 4% rise from the previous close. This upward movement comes on the back of a bullish outlook from Morgan Stanley, which has maintained a target of ₹320 per share.

📌 Quick Snapshot:

- Current Price: ₹298

- 52-Week High: ₹312

- 52-Week Low: ₹165

- Market Cap: ₹2,500 Cr+

- NSE/BSE Listed: Yes

📊 Price History & Technical Trend Analysis

Over the past 12 months, Eternal shares have delivered nearly 65% return, outperforming several mid-cap peers in the same sector. A combination of revenue growth, digital expansion, and AI-led automation in services contributed to this stellar rally.

Key Technical Indicators (as per Screener.in):

- PE Ratio: 22.5 (Moderate valuation)

- EPS: ₹13.2 (Improving)

- Return on Equity (ROE): 15.7% (Good)

More detailed metrics are available on Screener

📈 Why Eternal Shares Are Rising

There are several reasons why Eternal stock price is gaining momentum:

- 🔧 Sectoral Tailwind: Rising demand for digital services post-COVID.

- 💸 Strong Q4 Results: YoY revenue up by 18% and net profit up 22%.

- 🤝 Strategic Alliances: New B2B contracts in AI and digital backend.

- 🧾 Morgan Stanley’s Endorsement: Maintains “Buy” rating with a ₹320 target. Read full article on India Today Business

Analysts see strong support at ₹280 and resistance near ₹320. A breakout above the resistance could push the price to ₹350 levels in Q2 FY2025.

🔗 Outer Links for Deeper Analysis

Moneycontrol – Eternal Live Price

India Today – Eternal Share News

5 June World Environment Day 2025: Theme, Significance & How to Take Action